tax identity theft examples

Published on January 24 2022. Several action steps are encouraged with handy links and examples along with connections to various IRS resources see the Sidebar.

Some fraudsters might email your employees or customers while pretending to be your business.

. The following scenarios of identity theft are true and give you an idea what identity fraud really is. Among the most common examples are credit card fraud and perhaps one of the most frightening deceptions business identity theft. Identity Cloning and Concealment.

Personal tax ID theft happens when someone has stolen your personal information in order to file a fraudulent return. People can be charged with identity theft for nonconsensual use of someones personal identification information PII. Or obtaining access to facilities or services such as.

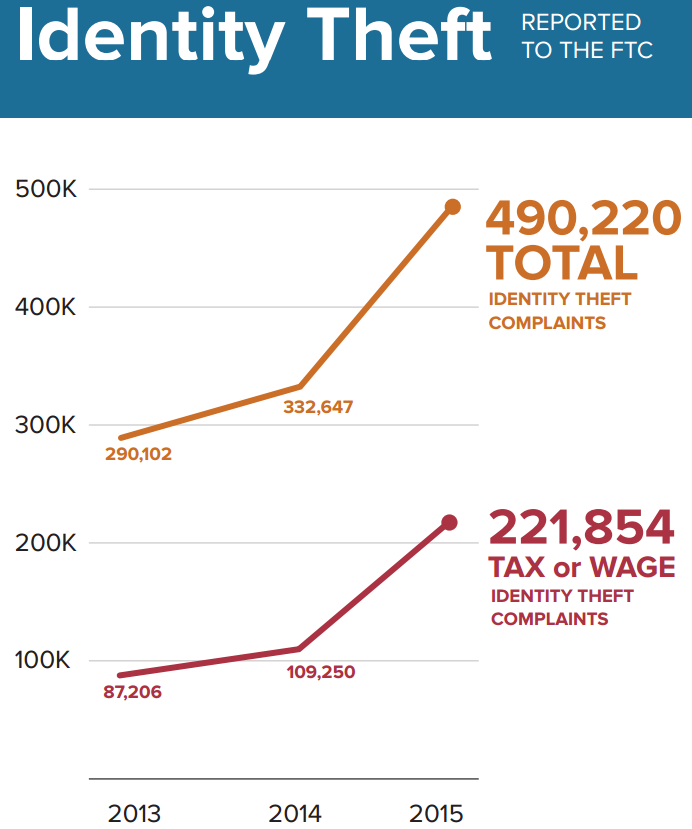

Tax identity theft is such a big program that the Federal Trade Commission each year hosts Tax Identity Theft Awareness Week starting on the last Monday in January. Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of. This happens if someone uses your Social Security number for employment or they used the information from your W-2 to file income tax returns on your behalf and take your tax refund.

Identity theft occurs when someone uses another persons personal identifying information like their name identifying number or credit card number without their permission to commit fraud or other crimesThe term identity theft was coined in 1964. Examples of identity fraud include using a false identity or someone elses identity details eg. Or obtaining goods or information.

In many cases an identity thief starts by using a childs Social Security number to open lines of credit obtain drivers licenses or even buy a house using a childs identity. During the week the FTC holds several webinars providing consumers tips on how to identify and avoid tax identity theft. Examples of Identity Theft.

Identity theft it is more common than you probably think. If this exploit is successful the victim is charged instead of the thief. Name address previous address date of birth etc for commercial economic or monetary gain.

ID fraud of a celebrity. When you hear the term identity theft the first thought that comes to mind may involve a data breach or opening a credit card in someone elses name. There are a number of tactics identity thieves use to profit off your small business.

Since that time the definition of identity theft has been statutorily defined throughout both the UK. But Im not afraid anymore because I faced down a nameless ghoul who did more actual harm to me than any imaginary monster could ever do. This type of identity theft occurs when the perpetrator wants to take on the identity of another in order to conceal his true identity.

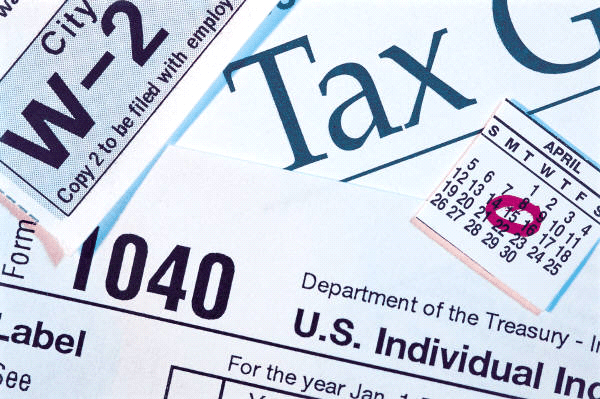

In 2022 the week will start Jan. Lenders use many different credit scoring systems and the score you receive with Identity Guard is not the same score used by lenders to evaluate your credit. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund.

An identity theft victim from Sarasota Florida realized she was a victim of identity theft when someone used her social security number to file taxes with the federal government. It is calculated using the information contained in your TransUnion or Experian credit file. Examples of signs of identity theft include receiving notices from the IRS on a variety of unexpected matters andwell known to tax preparersrejection of a tax return from e-filing.

My first experience with stolen identity happened when my parents told me to get a credit card. And the United States as the theft of. You can also be charged with identity theft trafficking for selling or transferring PII with the understanding that the recipient will use the PII for an unlawful act.

For example an illegal immigrant may steal a persons identity. It all started one fateful day when an identity thief used my name Social Security number and birth date to file a fraudulent tax return netting the fraudster a 4000 refund. Below are some recent identity theft stories from real people.

If you believe you have a been a victim of identity theft be sure to check all of your accounts. Some examples include employee theft tax fraud or embezzlement bribery or insurance fraud. Only five of these 369 examples mention the Individual Taxpayer Identification Number and each of these five cases describes a scheme to engage in refund fraud not employment related fraudHere are the five examples published by the IRSFiscal Year 2015 Former IRS Employee Sentenced for Wire Fraud and Identity Theft SchemeOn Aug.

The Social Security numbers of children are often extremely valuable because they do not have any information associated with them yet. Tax identity theft is usually identified when the victim goes to file their tax return and finds that one has already been processed for them. But another common type of identity theft involves the use of someones Social Security number to unlawfully intercept their income tax refund.

Conspirators obtained pre-paid debit cards in the names of identity theft victims and opened bank accounts in the names of conspiring visa holders who sold their account information before leaving the US. When you make uses of public Wi-Fi for example in a hotel or restaurant youre an easy prey. They then filed more than 400 fraudulent tax returns to seek more than 3 million.

If you suspect you are a victim of identity theft continue to pay your taxes and file your tax return even if you must file a paper return. Examples of business identity theft scams. There are a variety of forms of personal identification that a thief may steal from you.

We asked our community for identity theft case examples and unfortunately we got plenty of horrifying stories in return. Personal tax identity theft. These include the use of phishing emails fake invoices and tax filing.

Tax Fraud Identity Theft Examples. Tax Identity Theft Examples examples identity theft Edit. In this exploit a childs Social Security number is misused to apply for government benefits and open bank accounts or other services.

Heres what to do if you discover someone has been abusing your accounts. Stolen Checks If you have had checks stolen or bank accounts set up fraudulently report it to the check verification. External fraud is committed by any individual or entity outside of the company.

In this example a person under arrest gives stolen identity information to the police. There are a number of tactics identity thieves use to profit off your small business. Her insurance company immediately got her in touch with us.

Tax Id What Is Tax Identity Theft And How To Protect Yourself From It Marca

What Is Identity Theft Definition From Searchsecurity

Irs Letter 4883c Potential Identity Theft During Original Processing H R Block

5 1 28 Identity Theft For Collection Employees Internal Revenue Service

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

Ftc Tax Fraud Behind 47 Spike In Id Theft Krebs On Security

How Common Is Tax Identity Theft Experian

Ftc Tax Fraud Behind 47 Spike In Id Theft Krebs On Security

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

Irs Form 14039 Guide To The Identity Theft Affidavit Form

Identity Theft Examples In Real Life Fully Verified

What Is Digital Identity Theft Bitdefender Cyberpedia

The How And Why Of Tax Identity Theft Itrc

Understanding Your 5071c Letter What Is Letter 5071c Community Tax

What Happens After You Report Tax Identity Theft To The Irs H R Block

Identity Theft Examples In Real Life Fully Verified

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)